In the US, the pizza business is a significant sector of the restaurant business. Sales of the well-liked Italian meal have increased over the previous ten years due to customers’ options to order takeaway, arrange for delivery, or dine in. Pizza shops generate $65 billion in revenue in the US and employ 884,000 people across more than 78,000 locations. Over the previous five years, which include the pandemic’s disruption, their revenues have increased by an average of 3% annually.

As of 2023, 73,333 Pizza Restaurants were operating in the US, a 1% rise from 2022. With a compound annual growth rate (CAGR) of percent between 2023 and 2028, the worldwide pizza restaurant industry is expected to grow from an estimated USD million in 2022 to USD million by 2028.

Market of Pizza Chains

Due to fast-paced lifestyles and growing urbanization, convenience food is becoming more and more popular among consumers in the United States, which is driving the industry. In addition, producers’ ongoing efforts to innovate new products and offer a variety of pizza varieties in response to changing consumer preferences for certain foods and flavors benefit the market. The emergence of fast-casual pizza restaurants and the expansion of pizza franchises and outlets nationwide that offer premium, customizable pizzas in a quick-service environment are also driving the market’s expansion.

The Pizza Restaurants industry’s market size, measured by revenue, was $49.4 billion in 2023. What was the pizza restaurant industry’s growth rate in the United States in 2023? In 2023, the Pizza Restaurants industry’s market size decreased by 2.4%. According to estimates, the North American pizza restaurant industry will grow at a compound annual growth rate (CAGR) of percent from USD million in 2022 to USD million by 2028.

The pizza market in the United States is expected to increase at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2032. Some of the major factors driving the market are the growing consumer preference for convenience food as a result of fast-paced lifestyles, the growing popularity of inexpensive, ready-to-cook frozen pizzas, and the manufacturer’s ongoing efforts to innovate and introduce a variety of pizza variants.

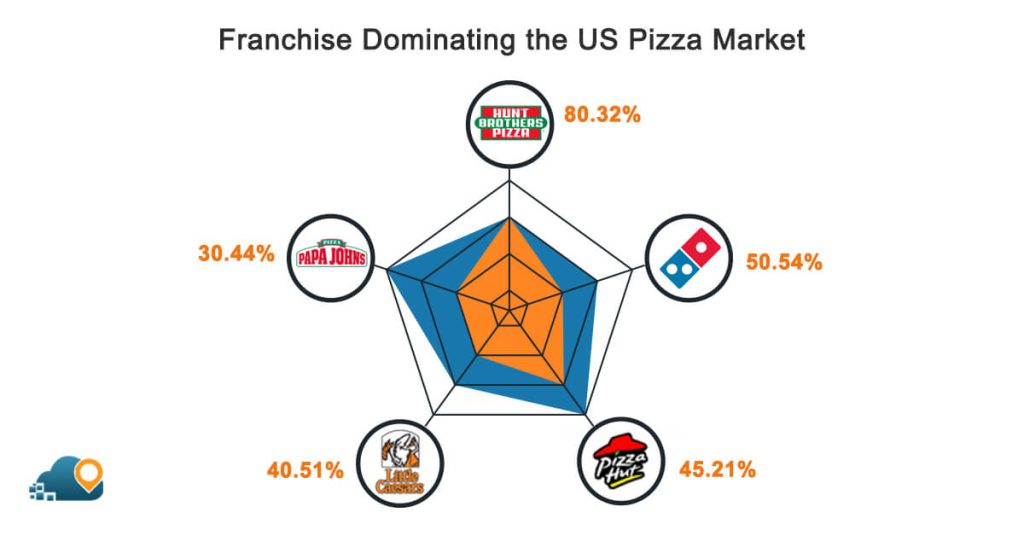

Franchises for Pizza

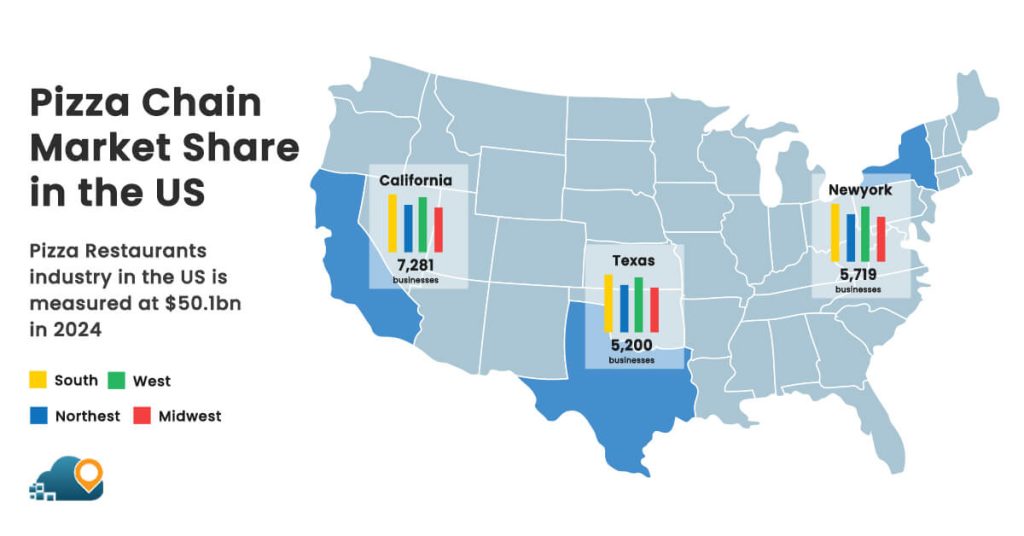

For franchisees, the pizza sector is alluring for reasons other than its size. These chains are dependable choices for a new company since they have strong brands and sizable, loyal customer bases. You may swiftly produce a product that people appreciate due to their processes and recipes. As of 2023, there are 73,333 Pizza Restaurants in the United States, representing a 1% increase over 2022. The states with the most Pizza Restaurants businesses in the US are California (7,281 businesses), New York (5,719 businesses), and Texas (5,200 businesses).

Given the continued growth of pizza franchises, analysts anticipate that Domino’s, one of the largest brands, will open more locations during the upcoming year. Even that report admits that royalties from Domino’s franchises have improved, even though some investors are leery of the brand because of a decline in revenue.

In this industry, there has always been intense competition. The wide client base of franchised pizza restaurants and the amount of revenue you can extract from each customer are at odds because of the current growth in competition and declining profit margins.

However, pizza is always profitable, which is why it accounts for such a sizable portion of the franchise industry.

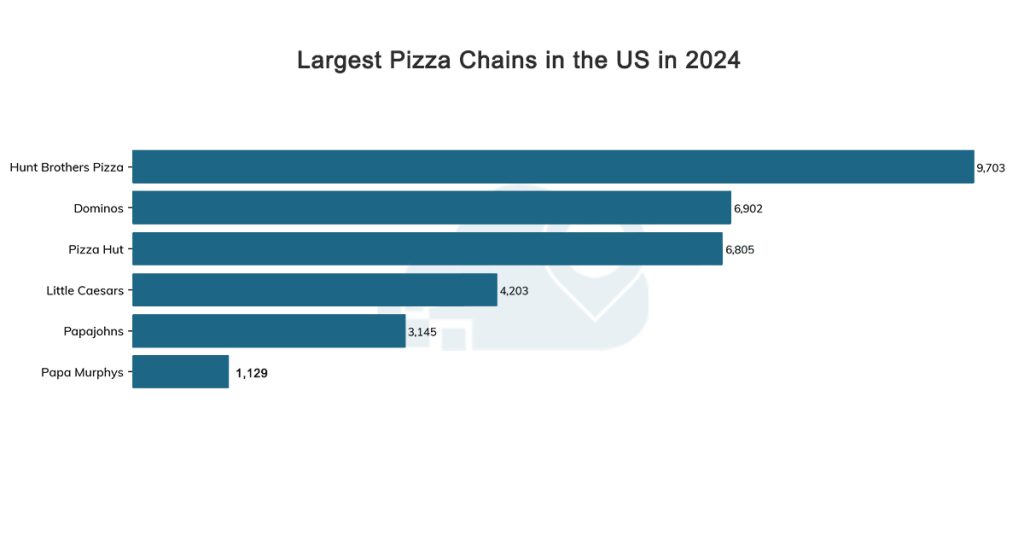

The Largest Pizza Chains for 2024

Hunt Brothers Pizza

Although the Hunt family has been involved in the pizza business for more than 50 years, Hunt Brothers Pizza, headquartered in Nashville, Tennessee, was founded more than 20 years ago. Don, Jim, Lonnie, and Charlie Hunt formally started working together in 1990 when they founded the Original Pizza House Pizza, a wholesale pizza business.

Hunt Brothers Pizza was the new name for the business in 2004 after it had been renamed Buffet Style Pizza in the 1990s due to its sustained popularity.

Hunt Brothers Pizza is considered the biggest brand for made-to-order pizza in the US. It is located in more than 25 states and has approximately 9,000 gas stations and convenience stores. The revenue of Hunt Brothers Pizza in 2023 was $3.3M, which was a great boost.

As per the latest analysis in February 2024, there are approximately 9,703 Hunt Brothers Pizza Store Locations in the USA. When considering the states with the most outlets in the USA, Texas is top on the list with 1041 stores. This is approximately 11% of the total outlets of Hunt Brothers Pizza in the USA.

Domino’s

Being one of the first pizza restaurants to concentrate on home delivery—a method that has grown in popularity—has contributed to Domino’s being the undeniable king of pizza. Keeping up with the latest advancements in order technology to ensure that clients may conveniently place their orders from the device of their choice is another key to its success.

In addition to creative menu options and delivery strategies, such as using its phone app to drop a GPS pin to designate a delivery area without a street address, Domino’s constantly conducts promos.

The company was founded in 1960 in Ypsilanti, Michigan, by brothers Thomas and James Monaghan. According to the company’s most recent annual report, there were 19,880 sites at the end of 2022 (up from 18,848), of which 286 were owned by the company and 13,194 were outside of the US.

As of February 27, 2024, there are 6,929 Domino’s Pizza locations in the USA. With 738 sites or almost 11% of all Domino’s outlets in the US, Texas is the state and territory with the most Domino’s locations nationwide.

Pizza Hut

Despite Domino’s having a larger market share than Pizza Hut, the latter is nevertheless easily able to hold onto its second place on this list because to a large number of devoted clients. The explanations are really straightforward: Pizza Hut delivers and provides a complete in-restaurant eating experience at many locations. The majority of Domino’s outlets don’t provide much of an in-restaurant eating experience; instead, its primary focus is on delivery. Pizza Hut has an advantage over Domino’s when it comes to those over 35, while Domino’s tends to be more popular with younger customers.

Founded in 1958 and offering franchising since 1959, the company’s number of locations is once again increasing, with a current total of 17,996 (up from a prior total of 17,358), of which 12,672 are situated outside of the United States and 21 are company-owned.

As of February 20, 2024, there are 6,805 Pizza Hut Store locations in the USA. With 920 locations or almost 14% of all Pizza Hut restaurants in the US, Texas is the state and territory with the greatest number of locations.

Little Caesars

Little Caesars prioritizes pickup (carryout, takeaway) above in-restaurant dining and home delivery. This chain uses a range of business techniques to maintain its competitiveness in a challenging market and to sell its pizzas for less than rival companies. These tactics include creating their own food distribution company, Blue Line Foodservice, and forming alliances for cheaper products or even producing their own.

Having been founded in 1959 and offering franchising since 1962, the most recent verified data available in 2017 indicated that there were 5,463 sites worldwide and in the US. In order to maintain cheap prices, the business also has fewer items on its menu and collaborates with shops to offer discounted kitchen equipment.

As of November 10, 2023, there are 4,203 Little Caesars outlets in the United States. With 540 sites, or almost 13% of all Little Caesars Store locations in the USA, California is the state and territory with the greatest number of Little Caesars stores.

Papa John’s

Papa John’s prioritizes delivery and takeout over in-store dining. It has had difficulty establishing itself in the fiercely competitive pizza business, but it is progressing thanks to its back-to-basics BIBP strategy, which emphasizes superior pizza and ingredients. It promises pizza created without using cheap, highly processed ingredients, using real cheese made from mozzarella, a sauce made from vine-ripened tomatoes, and fresh, never-frozen original dough.

Since its founding in 1985 and beginning to franchise in 1986, the firm has grown to have 5,968 locations worldwide, an increase from its previous total of 5,759. Of them, 2,693 are outside of the United States, and 612 are owned by the corporation.

As of February 13, 2024, there were 3,145 Papa john’s outlets in the United States. With 301 sites or almost 10% of all Papa john’s Store locations in the USA, Texas is the state and territory with the most Papa john’s locations.

Pizza Take ‘n’ Bake Papa Murphy’s

The sole nationwide pizza franchise is Papa Murphy’s Take ‘n’ Bake Pizza, which focuses mostly on providing “take and bake” pizzas that are built in the store and baked at home by customers. At the same time, some locations also provide home delivery. Papa Murphy’s places a high value on the freshness of its food, noting that none of its locations have freezers. Every day, they make their own dough from scratch, grind 100% whole-milk mozzarella cheese, and chop vegetables by hand. Of all restaurant companies, Papa Murphy’s claims the most devoted patrons—a distinction it has held for a number of years.

Established in 1985 and franchising since 1986, the company has experienced a decrease in the number of locations over the years, with a peak of 1,574 in 2016 and a current total of 1,178 (down from 1,217). Of these, 12 are owned by the company, and 39 are situated outside of the United States.

As of March 06, 2024, there are 1,114 Papa Murphy’s Store locations in the USA. Washington is the state and territory with the most Papa Murphy’s locations, with 145 sites, or almost 13% of all locations in the US.

Conclusion

There has always been intense competition in this industry. The current rivalry between franchised pizzas’ wide customer reach and how much you can extract from each client is exacerbated by declining profit margins. Although they didn’t used to make up a significant portion of the pizza industry, drive-thrus are growing more significant. There is a need for new outlets on new premises due to the growing complexity and size of drive-thrus, and in the appropriate location, this could present a new franchise opportunity. Once more, technology is crucial since efficient ordering platforms are essential, and some companies are considering utilizing artificial intelligence (AI) at drive-thru locations to boost productivity and cut labor expenses.

For Americans of all ages, pizza is still a favorite food, regardless of whether they can eat it at a restaurant. Based on a survey conducted in the first quarter of 2023, pizza was the most popular fast-food item ordered in the United States.