Retail clinics refer to medical facilities situated within pharmacies, supermarkets, and other retail environments. For a small variety of medical issues, from minor illnesses and accidents to preventative treatment like immunizations and physical examinations, these walk-in clinics offer basic, non-emergent care. Nurse practitioners (NPs) and physician assistants (PAs) work there. Cost-conscious customers are drawn to retail clinics since the majority of them take insurance plans and provide self-pay choices with clear, set prices.

The clinics offer vaccinations and other preventative treatments in addition to treating a restricted range of medical issues, such as minor wounds and infections. A physician assistant or nurse practitioner provides the care. Generally, prices are clear and set.

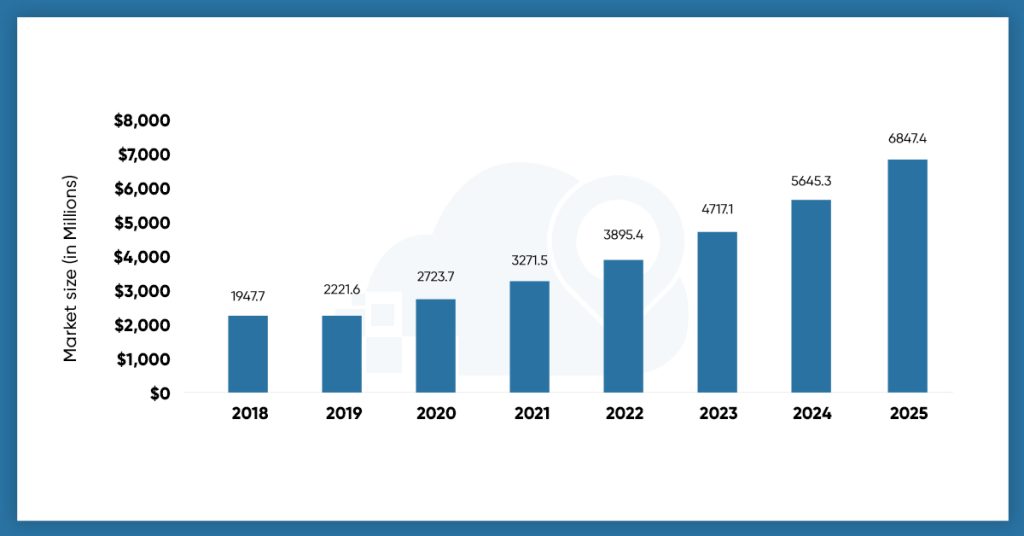

How US Retail Health Clinic Growing?

The retail health clinic industry in the United States is growing at a rate that has never been observed before due to an incredible rise. The walk-in clinic market has grown rapidly since 2018. It is a major player in the healthcare sector. Current estimates indicate that by 2025, this business will reach a valuation of 6847 million USD. It is good to look into the possibility of opening retail health clinics and the big players who now dominate the industry in the areas where they are situated because of this unusual increasing trend.

For non-emergency ailments, retail clinics have been suggested as a cheaper alternative to emergency room care. Up to 20 percent of ER visits for non-emergency conditions are thought to be appropriate for retail clinics or urgent care facilities, with the potential to save up to $4.4 billion a year in costs.

It’s important to analyze where these clinics are located to understand the impact properly. By checking out its location, we can see which areas can benefit from handy healthcare options nearby. This can assist us to see if there are more of these clinics in cities or rural places, which is useful info for healthcare planners and people making decisions about healthcare services.

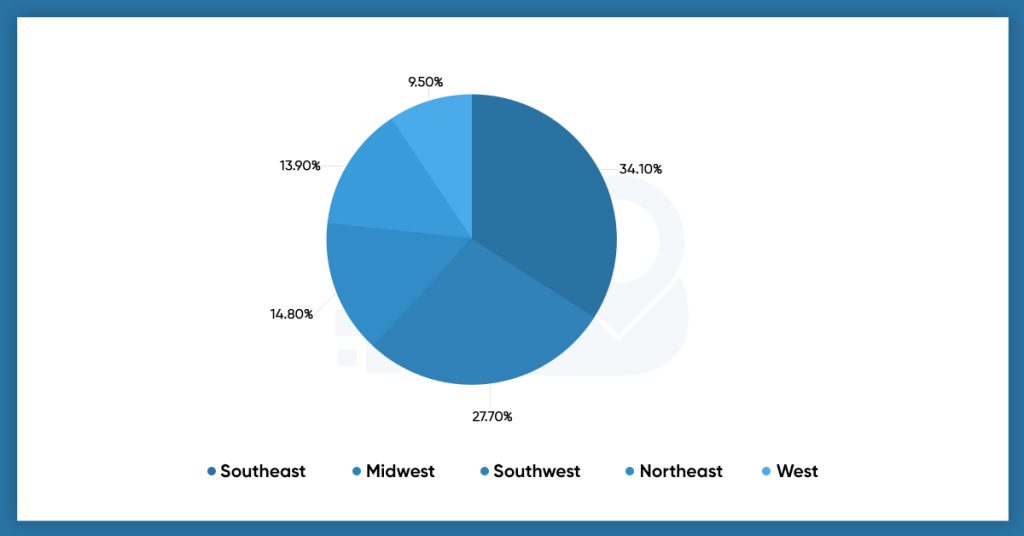

Regional Differences in US Retail Health Clinics

Regional inequities shape the accessibility and availability of retail health clinics. There are significant geographical differences in the US retail health clinic distribution. According to statistics from 2023, the Southeast area has significantly more retail health clinics than other regions, accounting for 34.10% of retail health clinics. The West is far behind, with only 9.50% of retail health clinic sites.

The Southeastern United States is considered the central point for healthcare. There are several aspects responsible for this, like how many people live there, how easy it is to get healthcare, and the local rules. Considering these aspects is very important for entrepreneurs looking to set up the services.

However, while considering the entire US segment, the Southeast segment is considered to be a big support for retail health clinics. On the other hand, the Western part is considered to be a new opportunity for the industry. Understanding these differences is vital for people who want to open these clinics or work in healthcare. Knowing that the Southeast is already doing well and that there’s a chance for growth in the West helps businessmen and healthcare specialists make intelligent choices about where to set up their clinics.

As the Southeast remains a great place for retail health clinics, the West looks like an exciting opportunity for new places. Figuring out these details is crucial for someone who wants to bring healthcare to different parts of the country.

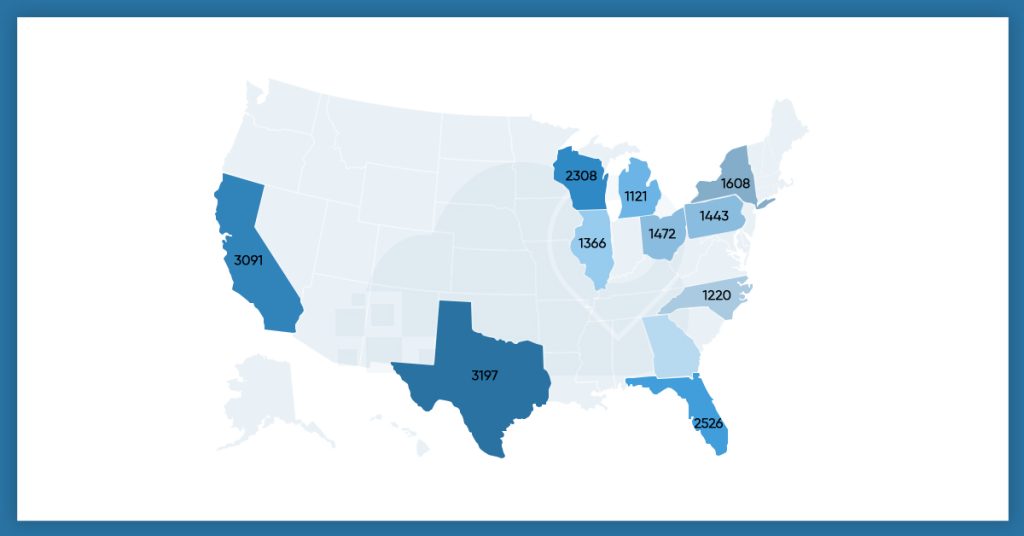

Geographical Distribution of Retail Health Clinic Locations in States

Understanding the geographic distribution of these clinics becomes increasingly crucial as the US retail health clinic market grows. According to data, several states and localities have developed into hubs for retail health clinic locations; this information is helpful for healthcare entrepreneurs and those who supply retail health clinic sites.

Over 1,800 retail clinics were in operation in 44 states as of 2023. Just 2% of these clinics were found in rural locations, and CVS owned half of them. These clinics were more likely to be found in large urban areas. With 62% of sites, the Southeast and the Midwest are home to most retail clinics.

After considering sixteen large clinics, the states with the most significant number of retail health clinic locations in the US were Texas, California, Florida, Wisconsin, and New York. Texas leads all US states with a remarkable 3197 retail health clinic sites among the clinics under consideration as of August 2023. Because of this concentration, those thinking about starting or expanding retail health clinics should consider these states as markets.

Texas is unique among the states in that it has an extensive network of retail health clinic sites. Hub cities like Austin, San Antonio, and Houston add a substantial amount of clinics to the state’s overall number of clinics. For US entrepreneurs, Texas locales such as these offer a microcosm of the broader national trend.

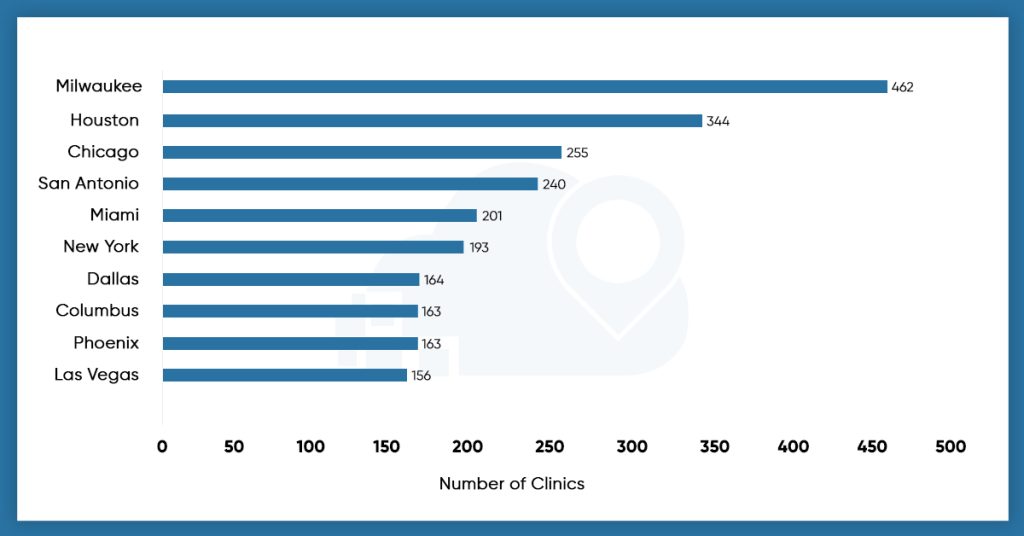

Milwaukee (462 sites) has the most retail health clinics in the United States as of August 2023, followed by Houston and Chicago.

Building a successful clinic involves careful planning and attention to key factors:

- Compliance with Regulations:

Following healthcare laws and getting the necessary licenses is crucial to running a clinic legally and safely.

- Choosing the Right Location:

Picking a good spot is vital. Being near busy stores, easy to reach, and in an area with the right kind of people are all important factors to think about.

- Deciding on Services:

Figuring out what kinds of healthcare services to offer is a big part of planning. Even though these clinics usually focus on basic care, it’s important to know what people in the area need.

- Using Technology:

Using things like online scheduling and electronic records can make the clinic run more smoothly and make it easier for patients to get care.

- Partnering with Big Providers:

Working with well-known companies in the healthcare industry can help the clinic be more successful. These partnerships can give access to more resources and bring in more patients.

Leading US Retail Health Clinics

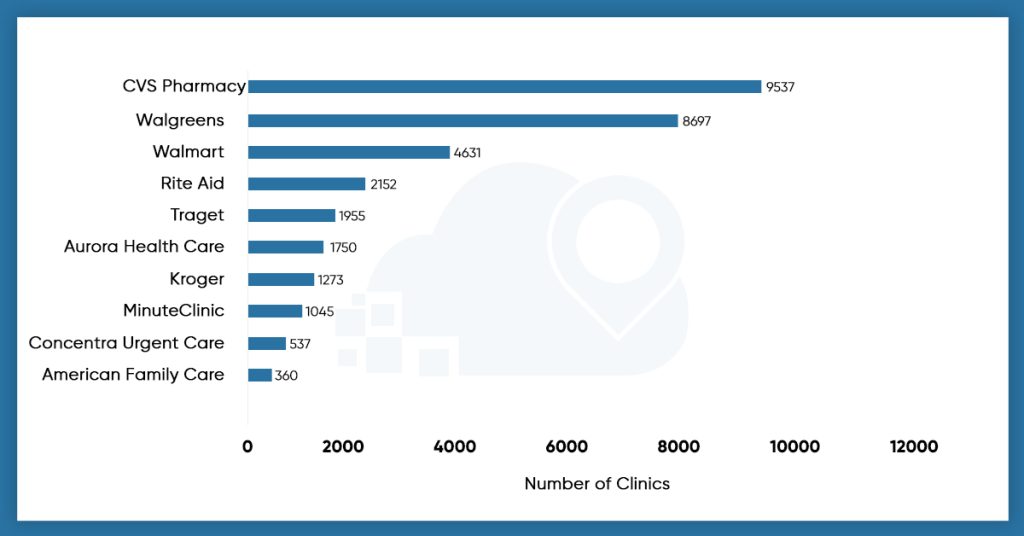

A few major providers control most of the retail health clinic market in the United States.

CVS now runs upgraded retail clinics dubbed HealthHUBs, which focus on chronic illness management. With the acquisition of Oak Street Health, a network of clinics catering to Medicare-eligible seniors, the corporation is increasing its focus on primary care. It also purchased Signify Health, a provider of in-home assessments.

Over 220 retail clinics are operated by the food behemoth across 35 states. Walgreens and CVS Pharmacy are the clear leaders, with Rite Aid and Walmart following suit. As of August 2023, CVS Pharmacy leads with over 9537 stores, closely followed by Walgreens with about 8697 sites.

Without including CVS and Walgreens, an overview of retail health clinics in the United States would be lacking. Both businesses have placed their outlets in advantageous locations, according to a detailed examination of state allocations. For example, Walgreens only has 565 stores in the same area as CVS, but CVS has 1132 sites in California alone. Because of their extensive reach, CVS and Walgreens are essential retailers of retail health clinics in the United States, particularly for those needing basic care and prescription drugs.

Compared to rural regions, nearly all retail clinics (97.9%) are in metropolitan areas. This makes sense From a commercial standpoint since businesses aim to reach as many consumers as possible. The following metro regions have the greatest concentration of operational retail clinics:

- Chicago, Illinois

- Georgia’s Atlanta

- Texas’s Dallas

- Arizona’s Phoenix

- Texas’s Houston

Patient Trends at US Retail Health Clinics

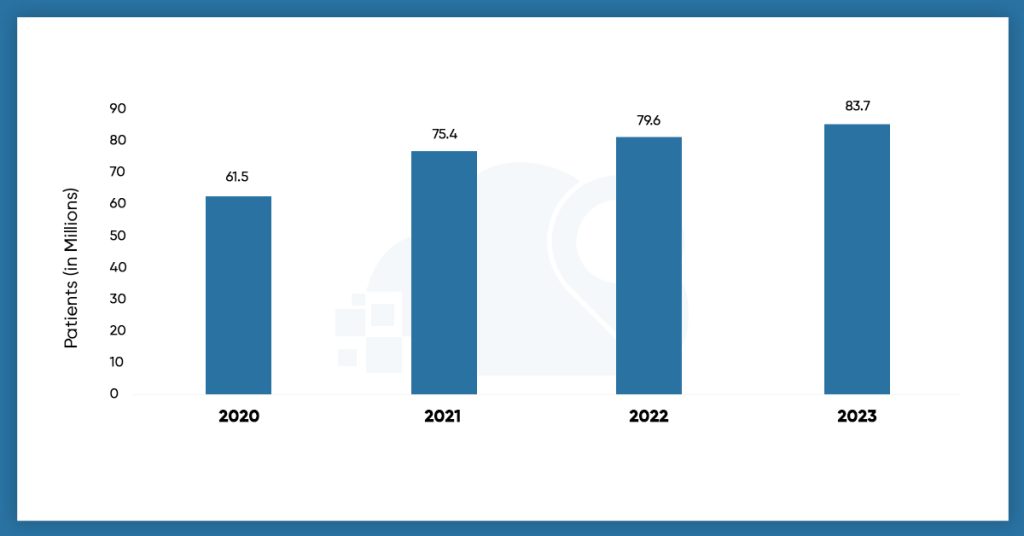

The rise in patient visits to US commercial health clinics highlights how the dynamics of healthcare consumption are changing. Recent research indicates that between 2020 and 2023, the number of patients visiting these clinics climbed significantly. The number of patient visits was 61.5 million in 2020, and by 2023, it is expected to rise to 83.7 million.

The majority of contemporary developments in the US healthcare system may be traced back to the idea of “patients as consumers.” As traditional treatment becomes less typical, this tendency has driven the expansion of retail clinics, which are becoming hubs for comprehensive care delivery.

According to a recent Bain & Company analysis, by 2030, emerging unusual care models like merchants may account for up to a third of the primary care market in the United States. Definitive Healthcare discovered that between 2017 and 2022, the amount of claims from retail clinics increased by 200%, indicating that the projection is off to a great start. The amount of claims from primary care physicians decreased by 13% throughout that time.

The growing popularity of retail health clinics is beneficial for all parties concerned. The demand for the services of companies that provide the facilities for these clinics may rise significantly as more people select them for their healthcare needs. These providers have a great chance to expand and offer additional healthcare options.

In view of this developing tendency, it is imperative to determine if the current number of retail health clinics in the US is adequate to meet the increasing client demand. This highlights the importance of these clinics and identifies areas where opening more clinics would be highly advantageous.

Conclusion

For anybody involved in the healthcare industry, whether it is a patient, a healthcare professional, or someone thinking about launching a healthcare business, it is essential to understand the design of retail health clinics in the United States. Through analyzing regional variations, patient flow, and major players in retail health clinic locations, people and organizations may leverage data-driven insights to make decisions that align with the healthcare requirements of the United States populace.

LocationsCloud’s datasets can help you better understand the landscape of retail health clinic locations in the United States. Access to this data can help with strategic planning and decision-making by providing insights on the distribution and trends of retail health clinics, whether you’re a researcher, healthcare professional, or company owner.