Along with bakeries and sandwich shops, cafes and coffee shops are part of the quick service restaurant (QSR) industry in the United Kingdom. Though some of their stores also sell tea, snacks, baked products, and short meals, coffee is their main product. There has been a growing trend in coffee shops operating in the UK over the past ten years, including branded chains and independent operators who are not experts. Since non-traditional vendors, including supermarkets and bars, began to provide specialty coffee menus, the number of non-specialists, in particular, has increased.

This analysis aims to analyze the geographic reach and consumer preferences to analyze the geographical study in the UK equipped with meticulous data. This research will be a reliable resource on the dynamics influencing UK coffee chains, offering practical business insights.

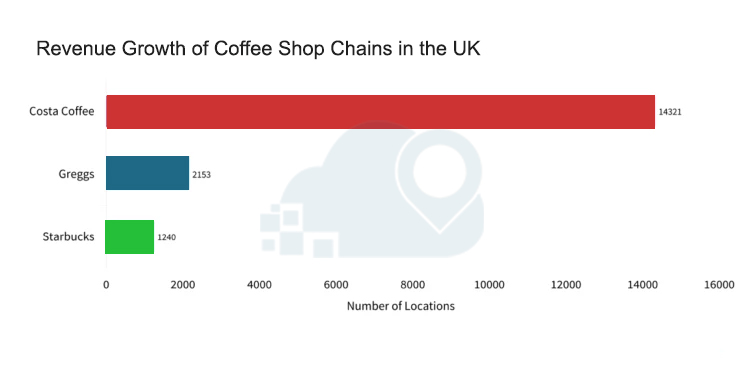

Revenue Growth of Coffee Shop Chains in the UK

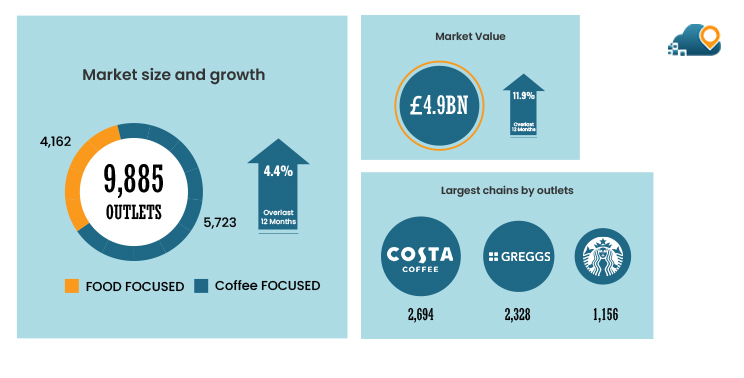

According to Project Café UK 2023, the £4.9 billion UK branded coffee shop market grew by 11.9% in revenues over the previous year, adding 4,4% to reach 9,885 locations. Nonetheless, operators continue to struggle with rising energy prices, inflation, and shifting customer behavior, resulting in sales below pre-pandemic levels. According to World Coffee Portal, there will be more than 10,200 UK-branded coffee shops by 2024, and by January 2028, there will be more than 11,600. Sales are expected to reach £6.4 billion by 2028, growing at a 5.6% CAGR.

This data provides a picture of consumer preferences and commercial tactics and a clear hierarchy among these heavyweights of the coffee industry. Stakeholders may make better business decisions by better understanding market saturation, customer choice, and regional dynamics by analyzing the distribution patterns of these top coffee shops in the UK.

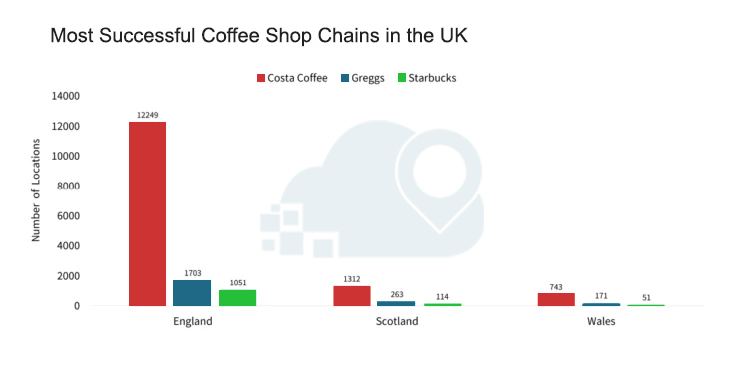

Most Successful Coffee Shop Chains in the UK

Coffeehouse businesses hold a dominant position in the UK market for cafes and coffee shops. Costa Coffee, Greggs, and Starbucks were the top chains of coffee shops in the United Kingdom. In the United Kingdom, chains accounted for 29.1% of the market share in 2005, whereas independent coffee shops experienced a challenging year with growth of only 2%. Although the UK has 14,022 coffee shops, 62% of coffee drinkers have visited one of the top 3 chains.

Understanding Top Coffee shop chains in the UK

The main competitors use several strategies to attract clients and grow their market share in the coffee industry. More than 40 million people used Costa Coffee in 2023, while 10.5 million people utilized neighborhood coffee shops. With more than 2694 locations around the UK, Costa is the leading chain of coffee shops in terms of franchise sales. 10% of Costa’s devoted patrons account for more than 50% of visits.

As per the latest statistics by Project Cafe 2023, the estimated average price of a 12-ounce coffee beverage is around 3.25 pounds. With a wealth of around 4.5 billion pounds, the branded coffee shop industry is a bustling and continuously growing industry in the UK, which is 11.9% more than the previous 12 months’ records. In terms of numbers, Costa coffee reigns the UK market with over 2690+ outlets, followed by Gregg’s coffee with around 2328 outlets in the UK, whereas Starbucks holds the third place with 1156 outlets as of December 2023. Note that the branded coffee market in the UK is an exponentially growing sector. It is projected to grow annually by 6.21% (CAGR 2024-2028).

Greggs increased revenues by 23% yearly, reaching £1.5 billion ($1.8 billion) in the last year. According to data from World Coffee Portal, Greggs was the second-largest competitor to Costa Coffee, with a 27% market share among UK-branded coffee shops as of January 2023, with a 24% share. Over that time, Greggs added 94 new locations while closing 44 to a total of 2,378. With the addition of 33 franchised locations, Greggs now has 466 franchised locations across its network.

Raise in Investment of International Branded Coffee Shops

International branded coffee shops continue to invest in the UK despite persistent trade issues related to inflation, the aftermath of the COVID-19 pandemic, Brexit, and the potential for a recession in 2023.

Tim Hortons, a Canadian chain that debuted in the UK in 2017, expanded its store count to 72 by adding 35 locations. The US specialty coffee business Blank Street made its UK debut in June 2022 and has since multiplied, running 12 locations around London. With its Esquires and Triple Two coffee shops, Cooks Coffee Company, located in New Zealand, continues to grow in the UK. Meanwhile, October 2022 saw the opening of Paris Baguette, the massive South Korean coffee chain with over 4,000 locations worldwide. Coffee Planet in Dubai has also revealed its short-term expansion goals for the UK.

US specialty coffee brand Blank Street Coffee made its UK debut in June 2022. Since then, it has quickly grown, with 14 stores in London. After receiving over $70 million in funding, Blank Street intends to use smaller stores to make the UK capital its second-largest market worldwide. By 2023, it hopes to have 25 UK locations. With its Esquires and Triple Two coffee shops, Cooks Coffee Company, located in New Zealand, continues to grow in the UK. In September 2022, the firm claimed year-over-year sales increase of 20% and 60% for each brand, respectively. By March 2023, the company intends to run 96 locations combined throughout the UK and Ireland.

Meanwhile, the massive South Korean coffee chain Paris Baguette, which has over 4,000 outlets worldwide, launched its first site in the UK in October 2022 and intends to have 20 franchised shops by 2025. The store debuted in London. Dubai’s Coffee Planet, which debuted in the UK market in 2018 with a store in Cardiff and revealed a 10-store expansion plan in mid-2022, made more investments in the UK branded coffee shop industry. Along with confirming its commitment to the UK market in 2022, the French bakery company Paul announced plans to more than quadruple its presence and reached 100 locations in 12 to 18 months.

The Restaurant Group, a Dubai-based company, will expand its portfolio of UK travel hubs in the boutique café market in 2023 by opening a Jones the Grocery store in Terminal 2 of Heathrow Airport. After the epidemic, Saudi Arabia’s Half Million has resumed trading in London, while South Africa’s Tashas is preparing to begin in the UK in 2023.

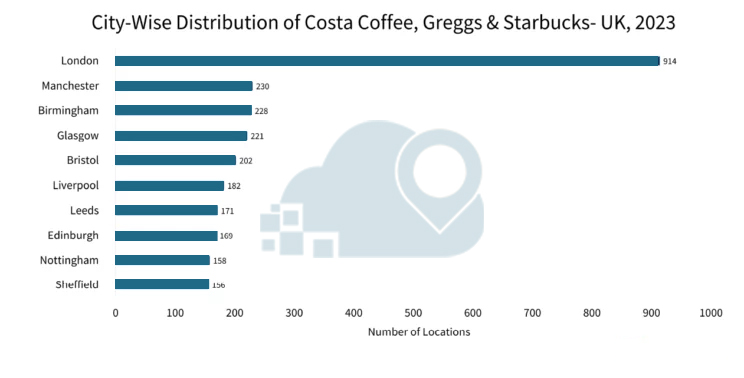

City-Wise Distribution of the Coffee Chains in the UK

After examining the national landscape, the next obvious step is to look at the city-level distribution of the UK’s leading coffee shop chains. This narrow focus makes it easier for us to identify trends at a more local level. It explains how Starbucks, Costa Coffee, and Greggs have made their names for themselves in different metropolitan areas.

London is the hub for all three chains, with a total of 914 Costa Coffee, Greggs, and Starbucks stores. This data indicates excellent rivalry in the city, further emphasizing London’s importance as a market for coffee businesses in the UK. Manchester and Birmingham are just a little behind London, with 230 and 228 stores, respectively, albeit still much less than London.

England is a dominant market in the UK coffee shop industry, with over 48% of all locations of these three significant chains being located in the country. Manchester and Birmingham are just a little behind London, with 230 and 228 stores, respectively, albeit much less than London.

Conclusion

Despite the cost-of-living crisis, consumers continue to find out-of-home coffee an affordable indulgence, as seen by robust sales and outlet expansion in the UK.

Additionally, non-specialist coffee shops are becoming prospective competitors in the coffee business by imitating chain coffee shops, fast food restaurants, and supermarket coffee shops. As a result, we have determined that the top three chains of coffee shops are their primary rivals now operating, and non-specialist coffee shops are potential competitors.

Examining the top coffee shop chains in the UK paints a convincing picture of market dynamics, consumer preferences, and geographical differences. To understand the complexities of the coffee franchises in England and elsewhere, Costa Coffee, Greggs, and Starbucks each provide a unique yet insightful perspective. A competitive advantage is essential as stakeholders navigate this complicated market. A more profound comprehension of market saturation, customer choice, and regional dynamics may be attained by grasping the distribution patterns of the top coffee shops in the United Kingdom. Developing successful company plans and making wise judgments require this information. Beyond coffee shops, the LocationsCloud Datasets empowers businesses with comprehensive data across diverse sectors.